workers comp taxes texas

Call an Experienced Workers Compensation Attorney Today. Unemployment Insurance Workers Compensation.

Veterinary Care In Wilmington 302 298 0841

The cost of workers compensation will vary in Texas.

. Ad Its Fast Easy To Get Workers Comp Coverage. The Texas workers compensation statutes are located in Texas Labor Code Title 5. Texas Governor Greg Abbott has appointed Jeff Nelson as the Commissioner of Workers Compensation at the Texas Department of Insurance TDI for a term set to expire on.

Limitations of Workers Comp Benefits. The Social Security tax rate is 62 percent of an employees income or earnings up to a maximum wage of 132900 for the 2019. As you can see there are limits to workers comp.

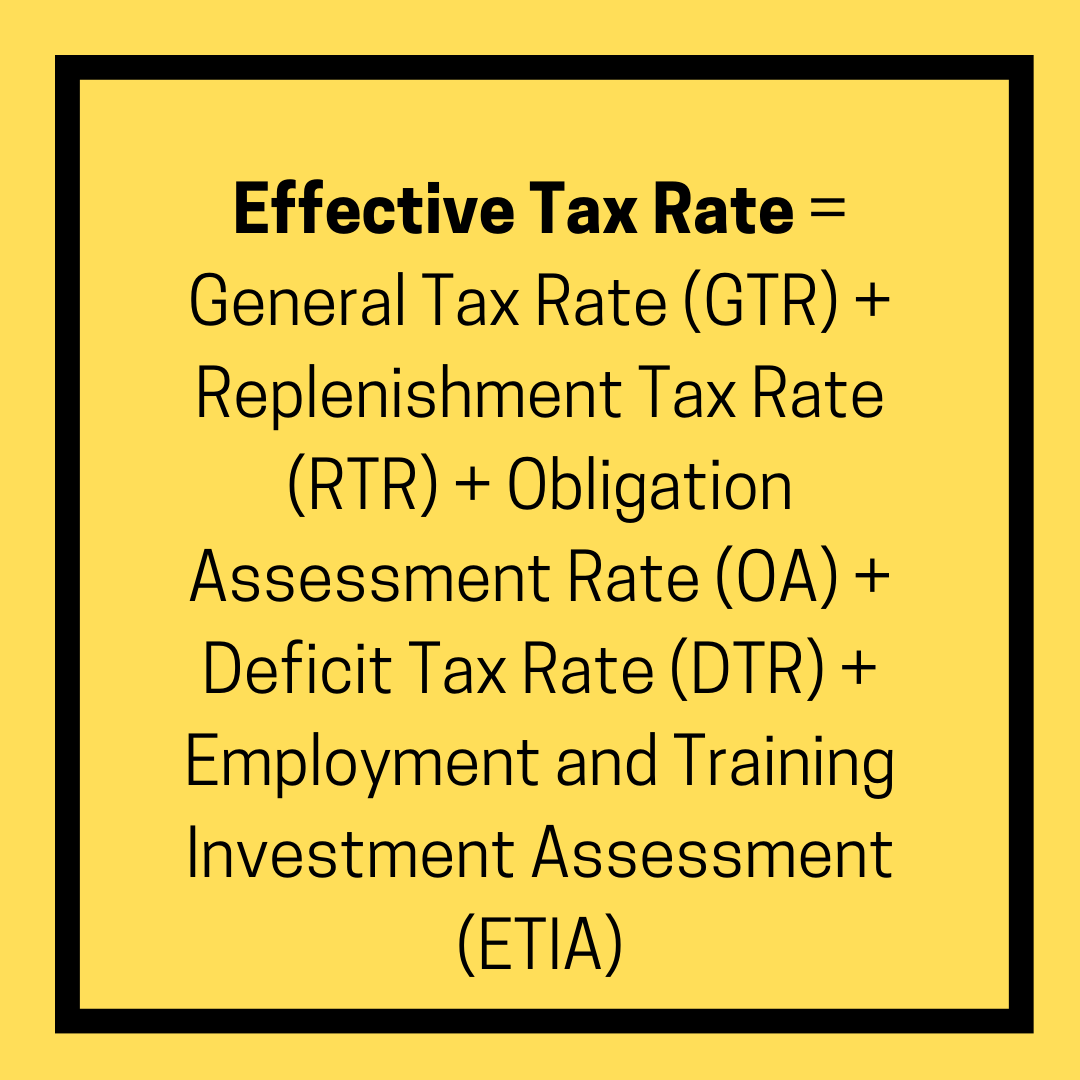

The Texas Department of Insurance is working hard to provide you with information you need to make informed choices about workers compensation insurance. Minimum Tax Rate for 2022 is 031 percent. 2 days agoGovernor Greg Abbott has appointed Jeff Nelson as the Commissioner of Workers Compensation at the Texas Department of Insurance TDI for a term set to expire on February.

We give expert advice about class codes owner exclusions. For employers the two FICA tax rates are. Employer costs for unemployment insurance and workers compensation are relatively low in Texas.

Our agents help TX business owners find the best workers comp insurance. In General Workers Comp Settlements Are Not Taxable For the most part you will not have to list workers compensation settlement money as income when filing your taxes. Ad Its Fast Easy To Get Workers Comp Coverage.

Subscribing to workers compensation insurance puts a limit. You pay unemployment tax on the first 9000 that each employee earns during the calendar year. Up to 25 cash back Workers comp will also pay up to 10000 for burial expenses.

If they use independent contractors they dont have to pay payroll taxes on them or buy workers comp insurance for. Texas Workers Compensation Act in PDF format. If you are receiving workers compensation benefits and have questions or concerns about which portion if any is taxable.

Texas unlike other states does not require an employer to have workers compensation coverage. Sole Props Entrepreneurs Small Shops Side Hustles. Maximum Tax Rate for 2022 is 631 percent.

Sole Props Entrepreneurs Small Shops Side Hustles. That fact entices many employers to try to cheat.

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Is Workers Comp Taxable Workers Comp Taxes

Is Workers Comp Taxable Do You Have To File Workers Compensation Income On Tax Returns Are Workmans Compensation Settlements Taxable

Do I Have To Pay Taxes On A Workers Compensation Settlement Workers Compensation Lawyers Ben Crump

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Protect Yourself From Identity Theft Cyber Attack Identity Theft Cyber Security

Free Nebraska Purchase Agreement Form Pdf 2883kb 17 Page S Page 2

A Complete Guide To Texas Payroll Taxes

The True Cost To Hire An Employee In Texas Infographic

California Republic Bear Flag Star Star Sticker Zazzle Com Star Stickers California Republic Print Stickers

General Contractor Estimate Template

Tax Id Number Employer Identification Number Irs Taxes Workers Compensation Insurance

アトリエ一級構造設計事務所 建築設計事務所 New Things To Learn Cool Websites Minimal Logo Design

2022 Federal State Payroll Tax Rates For Employers

Labour Lawyers In Dubai Employment Lawyers In Dubai Labor Lawyers

Free Washington State Month To Month Rental Agreement Pdf 241kb 7 Page S

9 Rental Property Tax Deductions What You Should Know Smartasset Rental Property Renting A House Homeowners Insurance